Charitable Giving, Taxes, Trusts, Stocks, and more.

Americans have a proud tradition of charitable giving. From the hours volunteered, to the Camo Classic, to individual giving, United Heroes League understands first hand and is grateful for the giving of proud Americans.

When you choose to give to United Heroes League, you have the opportunity to help military families while earning the ability to reduce your taxes. In fact, the federal government encourages charitable giving through a variety of tax incentives. Opportunities exist, even under the new tax law of 2017, to reduce your income tax, capital gains tax, and/or estate taxes. Gifts other than cash may allow you to make larger contributions to United Heroes League while enjoying a greater tax benefit to yourself.

Whether you are of modest means or in the wealthiest segment of our great nation, many different strategies are options as part of your financial or estate plan. Here are some ways to think beyond “cash” to pass on your values and legacy to the next generation, while supporting the mission of United Heroes League!

Gifts – Cash and Non-Cash Assets.

Cash donation is the easiest and most obvious way to give to United Heroes League. This type of donation is tax deductible in the year the contribution is made. It may reduce the amount of income tax due. There are limitations based on your Adjusted Gross Income so, please consult a financial professional for more information. Don’t have one, let us know, we can refer one!

Gifts of noncash assets (think stocks, bonds, property, etc.) may also be donated. This is a great strategy because the end result may be a larger donation to United Heroes League and tax benefit to you. When you donate a non-cash asset, you are entitled to the full fair market value tax deduction at the time of your gift. Additionally, direct donation of these assets may also eliminate capital gains taxes.

Contact us to find out if this could work for you.

Non-cash assets may include:

• Stocks

• Bonds

• Mutual fund shares

• Life insurance

• Private or restricted company stock

• Shares of a privately owned business

• Real estate

Note $6,000 more to the charity and $2,220 in tax deduction when donating the asset directly

*Assume married couple, filing jointly, and itemizing their taxes at the federal level. This does not take into account state, local or alternative minimum tax.

Life Insurance is also a non-cash asset worth discussing. You may work with United Heroes League to purchase a policy or gift an existing policy. When you purchase a policy, you can cost effectively make a gift far larger than you ever thought possible. United Heroes League receives the full benefit of the policy when you die or may be able to access the cash value of the policy for current needs.

In the gift of an existing policy, the donor may deduct the value of the policy on the date of transfer. For income tax deduction purposes, the value is the cost basis of the policy (premiums paid). Once United Heroes League owns the policy and is the beneficiary, all future premiums you pay to the charity are tax deductible as cash gifts

Bequeathed Gifts:

Simply put, these are gifts that occur after the donor dies through a Will or Testamentary Trust. These gifts (called testamentary gifts) are eligible for an unlimited estate charitable deduction. There are two common ways to do this: Wills and Life Insurance.

In your Will or Testamentary Trust, you can leave a flat dollar amount, a percentage, a specific gift or asset (like art, coins, stocks, etc.), or a contingent bequest. Gifting in this manner allows for flexibility (i.e. you can change your will), has tax benefits and acknowledges your legacy to the causes important you. Additionally, this mechanism is very efficient. Your wishes are expressed clearly and eases the settlement of your estate.

Another possibility for a bequeathed gift includes provisions for charities through beneficiary designations of living trusts, life insurance proceeds, or retirement plan assets that may remain at death. As the beneficiary of a life insurance policy, your estate receives a charitable estate tax deduction.

Four smart giving options:

Rather than donating cash, many of our donors are opting for smarter giving, non-cash options that not only support our mission but may also offer a variety of tax benefits. Click the link below to learn more about giving stocks, cryptocurrency, gifts from your IRA, and making a grant from a donor-advised funds.

Explore smarter giving options

Save taxes by donating stocks!

Donating stocks allows you to avoid capital gains tax and often take a charitable deduction for the full value of the asset. Use this online stock tool from FreeWill, donate stock so we can track your gift, send you the correct receipt, and you can get the tax savings you deserve.

If you would prefer to make your donation through your broker, access our transfer information to notify United Heroes League of your gift.

Save on taxes by giving from your IRA:

If you are 70.5 or older, giving from your IRA can help reduce your taxable income — and for those over 73 who must take a Required Minimum Distribution (RMD), an IRA gift if a simple way to fulfill it! Use this tool to give from your IRA, you can auto-complete your paperwork and we can track your gift to send you the proper tax receipts.

Easily make a grant from your Donor-Advised Fund:

Donor-Advised Funds (DAFs) are investment accounts for the sole purpose of supporting charitable organizations today.

Use this secure DAF link to:

• Automatically links with your DAF

• Allows you to recommend how you’d like your gift to be used

• Notifies United Heroes League of your intentions

We now accept Cryptocurrency donations!

We now accept donations of Ethereum, Bitcoin, and other cryptocurrencies! This gives us one more way to fund our work and provide you with extra tax benefits.

Trusts:

First of all, what is a trust? A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. For charities like United Heroes League, there are two types: charitable remainder trusts (CRTs) and charitable lead trusts (Cl Ts). The choice of trust largely depends on your personal preferences, priorities, and needs in regards to wealth preservation, tax planning, and estate planning.

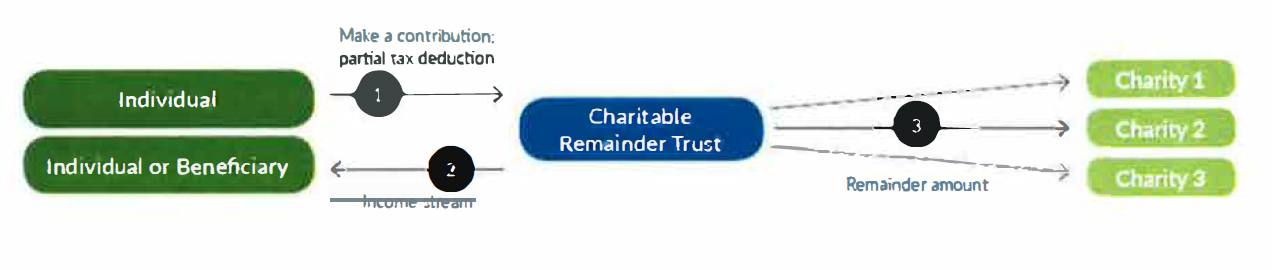

A charitable remainder trust allows you to receive a stream of income for a defined period of time, and any remainder go to a charity. A charitable lead trust is the reverse. It allows benefits to go to a charity, and the remainder to your beneficiaries.

Charitable Remainder Trusts (CRT):

A charitable remainder trust provides a lifetime income to the donor, allows a current charitable income tax deduction and permanently removes the asset from the estate.

The donor makes a gift to the charitable remainder trust. A stream of income payments is made by the CRT trustee to the donor for a set period of years or a lifetime. At the donor’s death, the assets remaining in the trust are transferred to the charity.

The donor may contribute cash, stocks, private business interests, private company stock, and other non-traded assets such as real estate. Depending on the financial situation of the donor, there may be strategies embedded with the transference of assets into the trust designed to generate income while taking tax deductions.

The CRT is a good option if you want an immediate charitable deduction but also have a need for an income stream to yourself or another person. If you set instructions to establish a CRT at your death, it is also a good option to provide for heirs, with the remainder going to charities of your choosing.

The CRT is a good option if you want an immediate charitable deduction but also have a need for an income stream to yourself or another person. If you set instructions to establish a CRT at your death, it is also a good option to provide for heirs, with the remainder going to charities of your choosing.

Want to learn more? Click HERE to visit a trusted partner.

Fed Tax ID # 27-0711063